|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Should You Refinance Your Home: A Comprehensive Guide to Making Informed DecisionsUnderstanding Home RefinancingRefinancing a home involves replacing your current mortgage with a new one, often with different terms. It's a strategic financial move that can potentially lower your interest rates, monthly payments, or even shorten the loan term. Why Consider Refinancing?

Pros and Cons of RefinancingAdvantages

Disadvantages

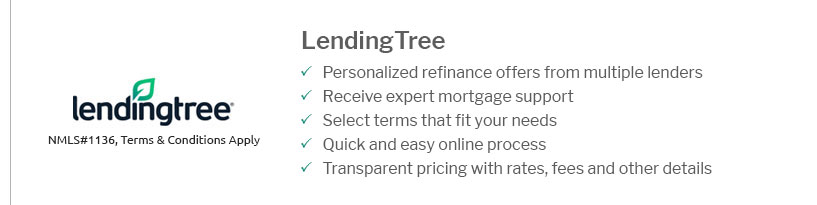

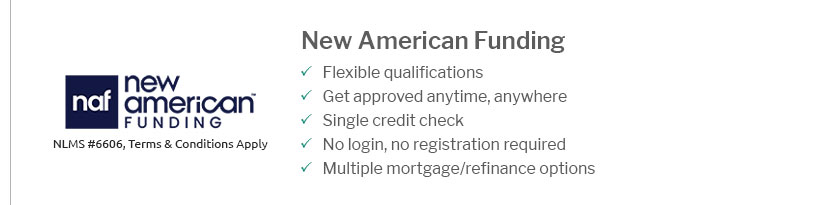

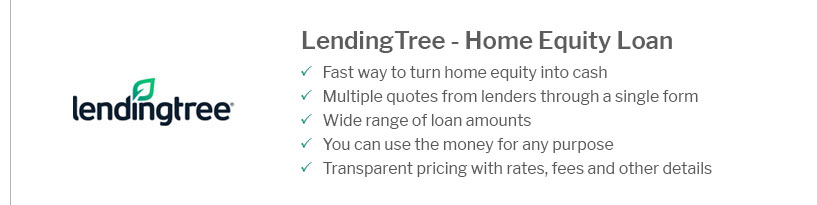

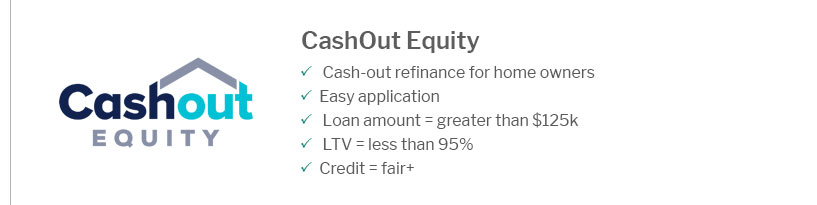

When is the Right Time to Refinance?Deciding when to refinance depends on various factors including current market conditions, your financial situation, and long-term goals. It is crucial to compare offers from best refinance banks to find the most suitable terms. Market ConditionsIf interest rates have significantly dropped or your credit score has improved, refinancing might be a beneficial move. Financial GoalsConsider your long-term financial objectives, such as paying off your mortgage sooner or reducing your monthly obligations. FAQsWhat does it mean to refinance a home?Refinancing a home means replacing your current mortgage with a new one, often to take advantage of lower interest rates, adjust the loan term, or access home equity. How do I know if refinancing is a good option for me?Refinancing could be a good option if you can secure a lower interest rate, want to change your loan terms, or need to access your home's equity. Evaluate your financial situation and consult with lenders to understand potential benefits and costs. Are there any downsides to refinancing?The downsides include potential closing costs, fees, and the risk of resetting your loan term, which could result in higher overall interest payments. https://www.lendingtree.com/home/refinance/when-to-refinance-mortgage/

If you're looking for better loan terms or want to access your home equity, a mortgage refinance can be beneficial. - Refinancing could help you lock in a lower ... https://www.newsnationnow.com/business/your-money/should-refinance-your-mortgage/

As a general rule, refinancing could be worthwhile if you're able to reduce your mortgage rate by at least 1 percentage point, said Ralph ... https://www.citizensbank.com/learning/refinancing-your-mortgage.aspx

Refinancing could lower your interest rate, change your loan type, adjust your repayment term, or cash out available equity. Visit Citizens to learn about ...

|

|---|